venmo tax reporting for personal use

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

For most states the threshold.

. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo. For example when you go out to a restaurant with friends and family and wish to. This new tax rule only applies to payments for goods and services not for personal payments between friends and family.

Registration is a piece of cake and you can use your contacts or email addresses to find your. Rather small business owners independent. A business transaction is.

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. The IRS views the payment andor receipt of money through Venmo or any similar peer-to-peer P2P app the same as a traditional payment andor receipt of cash. Venmo PayPal Cash App must report 600 in business transactions to IRS.

The tax-reporting change only applies to charges for commercial goods or services not. However if youve already. The best way to avoid having personal transactions reported to the IRS is to use separate Venmo accounts for personal and business transactions.

Ad Get 10 When You Sign Up For Venmo. In this guide well be exploring Venmo 1099 taxes. Just Fill Out Your Info Mobile Number.

If you sold 600 or more worth of goods you could be paying the taxman or at least needing to account for the income you earned on your tax. Just Fill Out Your Info Mobile Number. Keep track of your Venmo PayPal and other payment app transactions in case the IRS comes asking You are going to have to report revenue on goods and services of more than.

Ad Catch Vendor Tax Errors Before They Are An Issue With Avalara Consumer Use. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could. But CNBC says No the IRS isnt taxing your Venmo transactions It says a new law that took effect January 1st applies to small businesses to make sure they pay their fair share.

Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. Updated 316 PM ET Mon January 31 2022. If you use PayPal Venmo or other P2P platforms.

Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. If you need help to. Venmo is a payment processor made by PayPal for personal financial transactions.

Venmo Tax Reporting For Personal Use 2022. Well explain how to handle Venmo transactions and the taxes you need to be aware of. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

The app is simply a digital wallet connecting to your payment methods. Venmo and other payment services will have to report 600 or more in payments to the IRS and provide you with a 1099-K for the year 2022. Ad Get 10 When You Sign Up For Venmo.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. Previously the threshold was 20000 in. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Anyone who receives at least.

Tax Changes Coming For Cash App Transactions

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Truth Or Hoax Is The Irs About To Tax Your Venmo And Zelle Transfers Nbc4 Wcmh Tv

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

How To Stop Your Teenager Being Charged By The Irs For Sending Money To Their Friends On Venmo And Paypal

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

How Does Paypal Venmo Zelle Stripe And Square Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2019 By Steph Wynne Medium

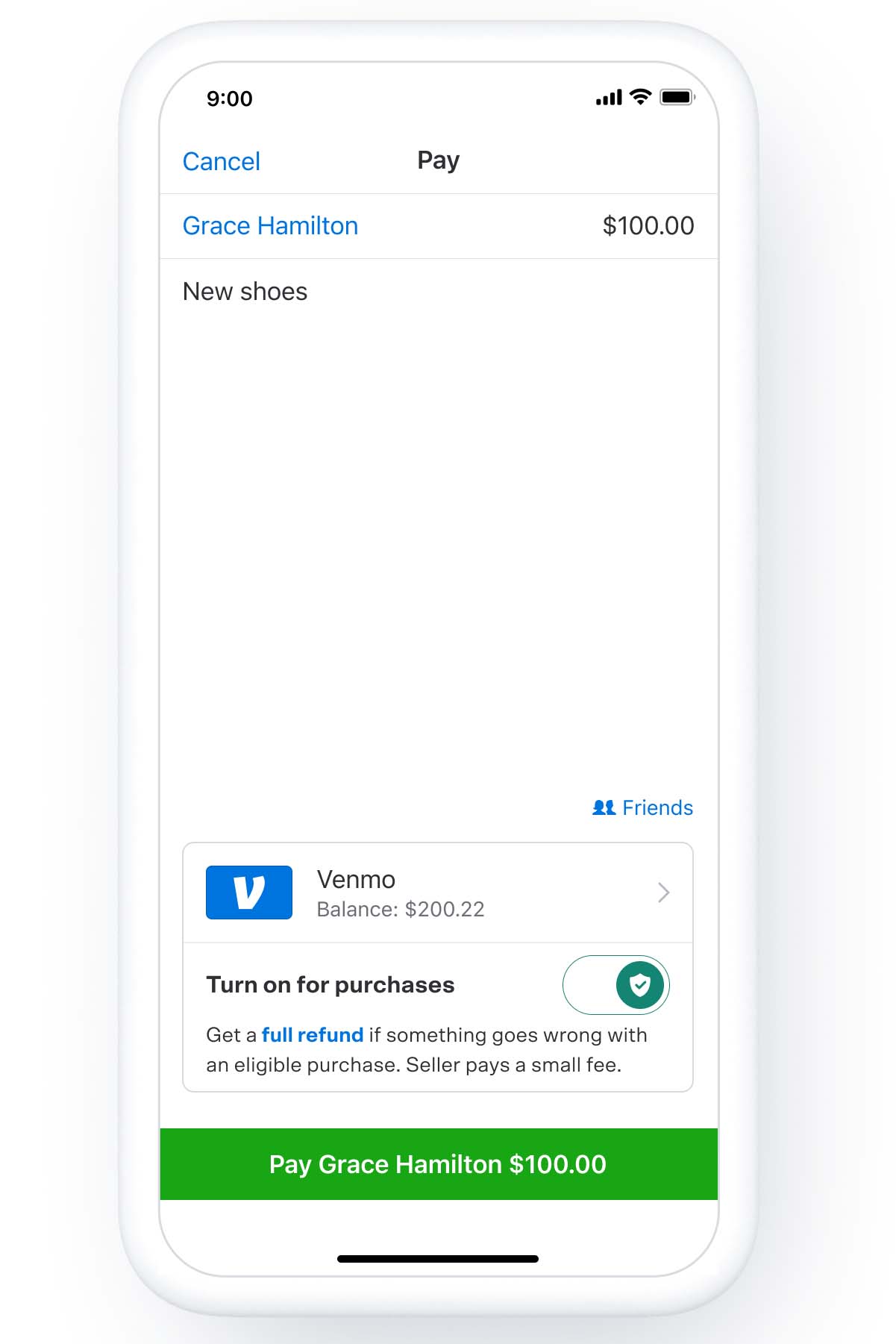

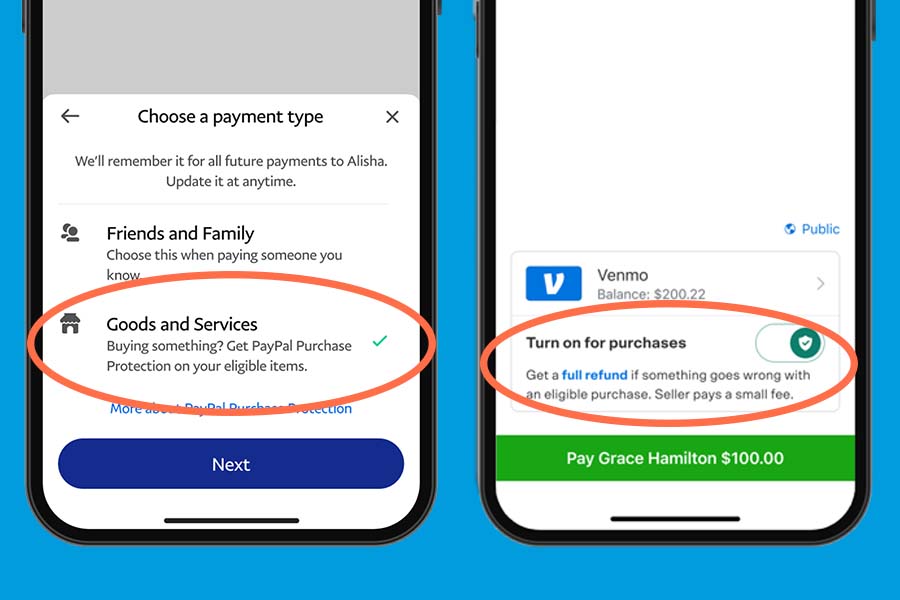

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Beware Of New Tax Rule Affecting People Who Use Venmo Paypal Or Other Payment Apps Tax Attorney Orange County Ca Kahn Tax Law

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Venmo 1099 Taxes For Freelancers And Small Business Owners

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New U S Tax Reporting Requirements 2022 Paypal Watchintyme

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com